Bad faith insurance tactics in semi-truck accident claims often begin before liability is even clear. Recorded statements, rushed processing, and selective documentation can reduce settlements by nearly 30% for serious crash victims. These moves show how an adjuster’s approach can shape the outcome long before a case reaches court.

Unlike regular car accidents, semi‑truck claims involve multiple carriers, layered insurance policies, and federal rules that create complex coverage disputes. Those conflicts give insurers room to delay, deny, or undervalue claims, leaving victims vulnerable to unfair practices.

Across the country, consumer‑protection laws require insurers to handle claims fairly, yet many companies still push for early recorded statements, impose artificial deadlines, and monitor social media to minimize exposure. Victims gain leverage by documenting medical care, wage loss, and pain journals, refusing recorded statements without counsel, and preserving black box data and driver logs early to strengthen valuation and prevent disputes.

For a deeper dive into recovery, see Compensation in Semi‑Truck Accident Cases.

Key takeaways

- Recognize insurer moves: Rushed statements, delays, and misrepresentation.

- Preserve evidence early: ECM, driver logs, maintenance files.

- Control communications: Centralize messages and avoid recorded interviews without counsel.

- Know consumer‑protection rules: Massachusetts Chapter 176D and similar state laws.

- Document losses thoroughly: Medical care and wage loss drive fair settlement value.

Bad Faith Insurance Tactics in Semi‑Truck Accident Claims: How Insurers Undermine Victims

Investopedia explains bad faith insurance as an insurer reneging on obligations by refusing to pay legitimate claims, delaying investigations, misrepresenting contract terms, or making unreasonable demands for proof. In semi‑truck accident claims, adjusters often exploit timing gaps, incomplete records, and early medical uncertainty to reduce payouts, shaping outcomes before liability is clear.

Denying or Delaying Semi‑Truck Accident Claims Without a Valid Reason

An insurance company may deny a claim with vague reasons or repeatedly “pend” requests to stall. Written, detailed explanations are required under good practices, but victims often face long waits that weaken their financial position.

Lowball Settlement Offers in Semi‑Truck Accident Cases with Artificial Deadlines

Companies sometimes make an early, minimal offer and impose a short deadline. This pressures claimants before full diagnostics and wage proofs are available, locking victims into undervalued settlements.

Misrepresenting Policy Coverage or Fault Rules in Semi‑Truck Accident Claims

Some adjusters misstate policy terms or comparative fault rules to reduce exposure. Misleading legal or policy claims can be evidence of unfair handling and may form the basis for a bad faith allegation.

Would you like me to move on and optimize the next section: “Why Semi‑Truck Claims Are Not Regular Car Accident Cases” in the same format?

“Coercive statements and unexplained delays are red flags warranting documentation and legal review.”

| Practice | How It Works | What To Do |

|---|---|---|

| Stalling | Repeated pends delay payment | Request written reasons and track response times |

| Low Offer | Quick deadline for acceptance | Refuse rush offers; gather medical proof |

| Record Mining | Social posts used to deny injuries | Limit public posts; preserve evidence |

For more on how insurers use these tactics to deny or minimize recovery, see Top Reasons Semi‑Truck Accident Claims Are Denied.

Why Semi‑Truck Accident Claims Differ from Regular Car Crash Cases

The Federal Motor Carrier Safety Administration (FMCSA) highlights how trucking regulations create complexities that ordinary car accident claims do not. Multiple carriers, overlapping primary and excess policies, and federal rules mean sequencing coverage matters for total compensation. These layers make semi‑truck accident claims far more complex than standard auto cases.

Multiple Policies and Layers of Coverage

Commercial operations stack primary, excess, and umbrella policies. A dispute over which policy pays first can cut available recovery substantially, leaving victims vulnerable to gaps in compensation.

Federal Rules, Black Box Data, and Commercial Regulations

Hours‑of‑service logs, maintenance records, and ECM “black box” files reveal speed, braking, and duty cycles. Early preservation is critical because routine overwrites erase key data, and federal trucking rules make this evidence central to proving liability.

Catastrophic Injuries and Long‑Tail Medical Care

Semi‑truck collisions often cause spinal and brain injuries that require lifetime care. Standard car accident formulas miss future medical needs, home modifications, and lost earning capacity, making specialized valuation essential.

Specialized experts—reconstructionists, biomechanical analysts, vocational specialists, and life‑care planners—are critical to prove causation and quantify long‑term damages. For more detail on these legal complexities, see Why Semi‑Truck Accident Cases Are Unique.

How Insurance Companies Exploit Multi‑Party Liability in Semi‑Truck Accidents

BusinessInsurance.com explains how multi‑party liability complicates semi‑truck accident claims and why disputes often extend beyond the driver to include trucking companies, manufacturers, and maintenance providers. After a semi‑truck accident, carriers and vendors frequently scramble to shift blame, slowing resolution and reducing the chance of a timely settlement for victims.

Finger‑Pointing in Semi‑Truck Accident Claims: Driver, Carrier, Loader, and Manufacturer Liability

Each company may blame a different party to limit exposure. One insurer may fault the driver’s conduct, while another points to negligent loading or a defective component. Conflicting narratives obscure causation and stall progress in semi‑truck accident claims.

Coverage Disputes in Semi‑Truck Accident Cases: Primary vs. Excess Policies and Exclusions

Disputes over which policy pays first often arise. Carriers cite lapsed endorsements or scope‑of‑employment issues to deny responsibility. These coverage fights can freeze settlements even when fault is clear, leaving victims without timely compensation.

The MCS‑90 Endorsement’s Strategic Role in Semi‑Truck Accident Claims

The MCS‑90 endorsement acts as a federal backstop. It can provide payment when a policy exclusion would otherwise bar recovery, but it usually comes after primary limits are used. Insurers may pay under MCS‑90 and then seek reimbursement, creating secondary disputes that complicate recovery.

Victims should document all insurer statements and positions as they change, and preserve loader records, maintenance logs, and black box data as critical evidence. For more detail on how lawsuits unfold when multiple parties are involved, see Multi‑Party Liability in Semi‑Truck Accidents.

| Issue | How Parties Respond | What To Track |

|---|---|---|

| Blame Shifting | Driver vs. carrier vs. manufacturer | Witness reports, photos, ECM |

| Coverage Order | Primary vs. excess debates | Policies, endorsements, payment history |

| MCS-90 Use | Federal payment then reimbursement claims | Endorsement language, court filings |

“Courts may use declaratory actions or special masters to allocate responsibility and speed resolution.”

The Evidence Playbook: Documenting Semi‑Truck Accident Damages for Maximum Recovery

TruckingInfo.com highlights the critical role of evidence preservation after truck crashes, noting that one misstep—like failing to save black box data or maintenance records—can undermine a victim’s case. A focused evidence strategy counters low offers and shifting narratives; timely preservation and clean documentation shape valuation and limit an insurer’s ability to undercut long‑term needs.

Medical Records, Wage Loss, and Pain Journals

Assemble complete medical documentation: diagnostics, specialist notes, PT/OT reports, prescriptions, surgical plans, and life‑care projections. These items show current care and quantify future medical needs.

For wage loss, collect payroll records, tax returns, HR letters, and vocational assessments. Together these documents prove lost earnings and diminished earning capacity.

Daily pain and activity journals that mirror provider notes illustrate functional limits and support damages for daily living and work impact.

Preserving Black Box, Driver Logs, and Maintenance Records

Send immediate preservation letters demanding retention of ECM/black box files, ELD logs, maintenance records, and dispatch communications. Routine overwrites erase key evidence, making early action critical.

Create an indexed evidence file so an adjuster’s team can’t ignore gaps. Link records to valuation models to counter quick settlement offers and show why fair compensation must include long‑tail damages. Audit social media and limit posts to prevent a company from using content to undercut injury narratives.

For a deeper dive into building a strong case, see Evidence in Semi‑Truck Accident Cases.

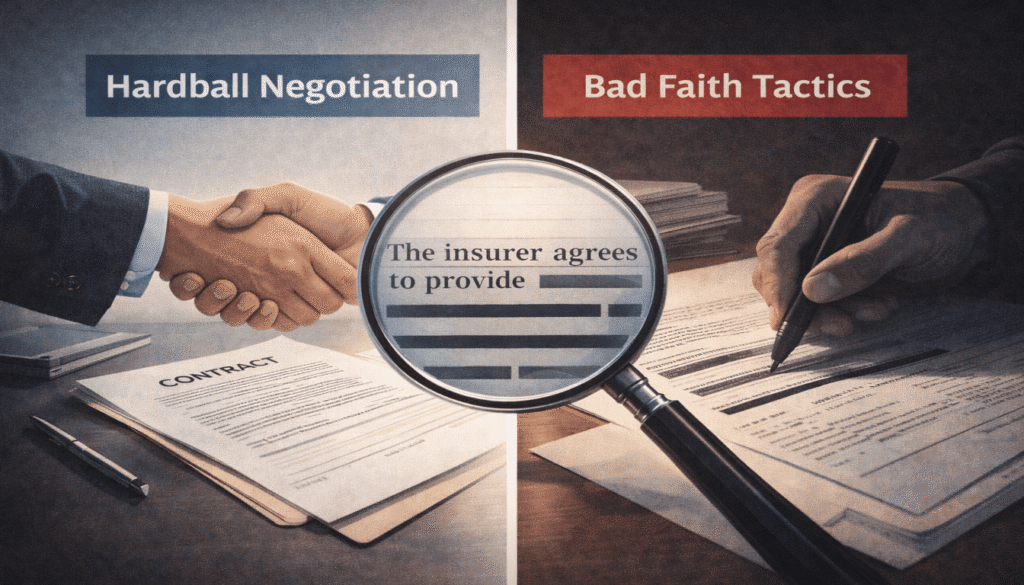

Spotting Bad Faith Insurance Tactics vs. Hardball Negotiation in Semi‑Truck Accident Claims

Cornell Law’s Legal Information Institute explains that bad faith occurs when insurers cross the line from firm bargaining into unlawful conduct, such as delays, coercion, or misrepresentation. In semi‑truck accident claims, recognizing these patterns is critical to protecting your rights.

Unreasonable Delays, Non‑Responses, and Communication Breakdowns

Insurers may stall by failing to return calls, requesting documents already provided, or shifting rationales for denial. While hardball negotiation relies on evidence‑based offers and timely counteroffers, persistent silence or form‑letter responses that ignore clear proof often signal bad faith.

Threatening Statements and Misstatements of Law or Facts

Coercive tactics like “you must settle today” or unsupported claims of fault should be documented immediately. Misrepresenting recording requirements or policy scope may also cross into unlawful conduct. Across the U.S., most states recognize an implied covenant of good faith and fair dealing, and many have statutes modeled on unfair claims practices acts that require prompt, fair investigations and prohibit misleading statements.

Checklist for Spotting Bad Faith in Semi‑Truck Accident Claims

- Unreturned calls or unexplained file transfers

- Circular record requests for documents already submitted

- Coercive statements documented with contemporaneous notes

- Written explanations demanded for any denial tied to specific policy terms and facts

| Problem | How To Respond | When To Escalate |

|---|---|---|

| Non-response | Send dated follow-ups and a preservation letter | After two missed deadlines |

| Circular requests | Provide a cover list and timestamped proof | When repeats continue |

| Coercive statements | Request written confirmation and log the call | Immediately |

“Keep every message and date-stamp interactions; a clear record often proves patterns of misconduct.”

Next steps: prepare a formal demand, consider a regulatory complaint, and preserve all correspondence. These actions create leverage for a fair settlement or legal remedies.

For more detail on how insurers delay and deny claims, see Semi‑Truck Accident Claims.

Legal Tools to Fight Back Against Bad Faith Insurance in Semi‑Truck Claims

When coverage or priority disputes arise, prompt court intervention can end gamesmanship and move cases forward. Attorneys use targeted legal tools—grounded in consumer‑protection standards and civil procedure—to force clarity, preserve leverage, and protect victims’ rights.

Leverage of Consumer Protection and Good‑Faith Claims Handling Standards

State consumer‑protection rules empower attorneys to demand timely investigations and written explanations for denials. These frameworks prohibit misrepresentations and enable regulatory complaints when carriers ignore duties. Nationwide, most jurisdictions recognize an implied covenant of good faith and fair dealing, and many adopt unfair claims practices acts that require prompt, fair claim handling.

Using Interpleader, Declaratory Actions, and Court Oversight

Interpleader resolves disputes among competing claimants when policy limits are constrained, stopping finger‑pointing and fragmented negotiations. A declaratory judgment action forces the insurer to state coverage positions under oath, removing ambiguity about exclusions and endorsements. For clarity on these tools, see Cornell Law’s pages on Interpleader and Declaratory Judgment. Court oversight—through scheduling orders and status conferences—helps enforce deadlines and curbs delay tactics.

Strategic Bad Faith Notices and Beyond‑Policy‑Limits Exposure

Well‑documented notices can create exposure above policy limits if a reasonable settlement is refused. Attorneys build the record by cataloging delays, lowball offers, and misstatements, positioning the case for extra‑contractual remedies and stronger negotiation leverage.

Timing Considerations and Statutes of Limitations

Acting early is critical. Short retention windows for ELD/ECM data and applicable statutes of limitations make prompt preservation and filing essential. Lawyers can move to compel production, seek appointment of a special master, or request firm deadlines that keep discovery and settlement on track.

For key deadlines that protect your claim, see Statute of Limitations for Semi‑Truck Accidents.

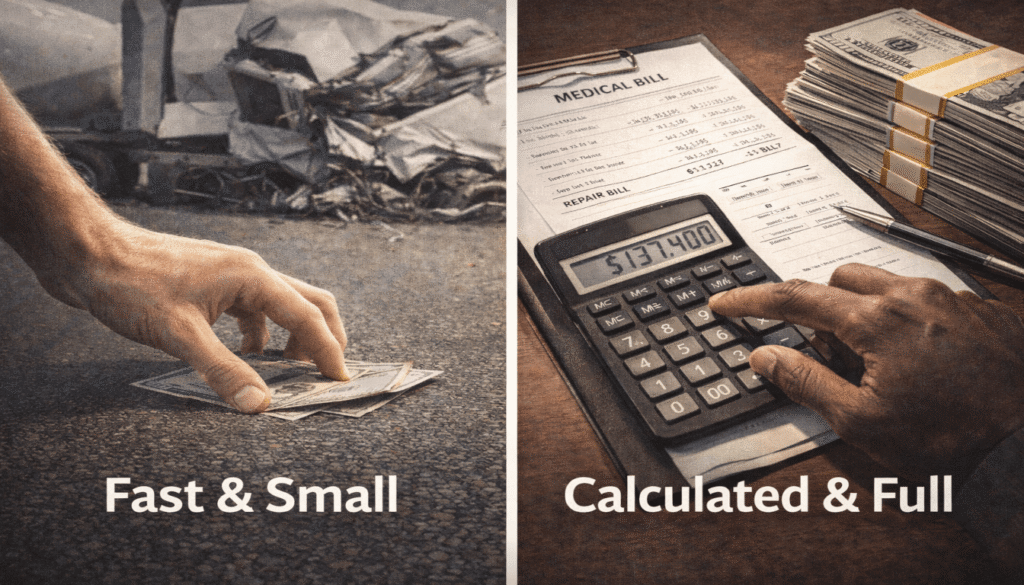

The Danger of Quick Settlements in Semi‑Truck Accident Cases — and How to Value Your Claim

Guidance from the American Bar Association on legal fees and expenses highlights why victims should fully understand the financial implications of settlement decisions. Quick‑release offers often arrive before medical trajectories are clear, leaving future care unaccounted for. In semi‑truck accident cases, early settlement offers can close a file before surgeries, rehabilitation, or assistive needs appear. Once a release is signed, most additional damages cannot be reopened.

Why Quick Settlements Undervalue Claims

Insurance companies may anchor low by citing selective records and ignoring specialist reports or life‑care projections. Artificial deadlines are designed to pressure claimants into accepting less than full value. Declining these tactics and demanding itemized bases for any offer helps ensure that long‑term needs are not overlooked.

Comprehensive Valuation Must Cover

- Past and projected medical expenses

- Lost wages and diminished earning capacity

- Pain and suffering damages

- Property loss and replacement costs

- Long‑term life‑care needs

Protecting Your Rights

Claimants should resist pressure to sign early releases and instead work with counsel to document the full scope of damages. A thorough valuation strategy ensures that settlement negotiations reflect both immediate and future impacts. For a broader look at pitfalls to avoid, see Mistakes to Avoid After a Semi‑Truck Accident.

| Component | What To Include | Why It Matters |

|---|---|---|

| Medical | ER notes, specialist reports, future surgeries | Shows true treatment needs and costs |

| Income | Pay stubs, vocational report, tax records | Proves lost earnings and capacity |

| Non‑Economic | Pain journals, daily activity limits, life‑care plan | Captures suffering and long‑term support |

Practical steps: use treating physicians’ narratives, vocational analyses, and life‑care plans to counter generic formulas.

“A deliberate process protects compensation and prevents forfeiting recovery for later complications.”

How an experienced semi‑truck accident lawyer levels the playing field against insurers

Experienced counsel reshapes a case from the first day. They move quickly to protect fragile evidence and set a course for full recovery. Early steps matter: a lawyer mobilizes investigators and experts to secure scene evidence, ECM data, driver logs, and maintenance files before routine overwrites erase them.

Early investigation, evidence preservation, and coverage mapping

An attorney identifies all responsible parties — driver, carrier, loader, maintenance contractor, and manufacturer — and locates every policy layer. Coverage mapping aligns primary, excess, umbrella, and MCS‑90 limits so negotiations target all available recovery, not just the most visible policy. For context on enforcement and compliance resources available at the state level, see the FMCSA’s State‑Level Enforcement Resources.

Negotiation strategy across multiple insurers

Counsel centralizes communications to prevent insurance adjusters from eliciting harmful statements or exploiting inconsistencies among parties. They use coordinated sequencing to pressure companies, leverage potential bad faith exposure, and build a damages narrative that helps recover compensation the client deserves.

| Role | Action | Impact |

|---|---|---|

| Lawyer | Preserve ECM/logs; hire experts | Anchors liability and evidence |

| Counsel Team | Map policies; align settlement order | Maximizes total recovery |

| Negotiation Lead | Centralize insurer contact; deter delay | Improves timelines and offers |

| Recovery Planner | Structure payouts; manage liens | Protects long-term compensation deserve |

To learn more about how to evaluate legal representation, see How to Know If Your Lawyer Specializes in Semi‑Truck Accident Cases.

Protecting Your Semi‑Truck Accident Claim Through Documentation and Counsel

Prompt documentation and early evidence preservation are the most effective counters to deceptive company practices. Victims should record every contact, demand written justifications, and track deadlines to expose unreasonable insurer conduct.

Preserve ECM files, driver logs, and maintenance records immediately so companies cannot shift fault or minimize damages. Centralize communications and save dates, names, and statements to build a clear record of insurer behavior.

Consult an injury attorney early. A lawyer can file preservation motions, map coverage, and frame negotiation to protect present and future medical care and lost earnings. With experienced counsel, victims can level the playing field against insurers and ensure that every layer of coverage is pursued.

Take action today: begin documentation, centralize files, and review next steps with counsel. For a deeper understanding of what victims can recover, see Compensation in Semi‑Truck Accident Cases.

Frequently Asked Questions About Bad Faith Insurance in Semi‑Truck Accident Claims

What are common signs an insurer is acting in bad faith after a semi‑truck accident?

Warning signs include unexplained delays in responding, denials without reviewing evidence, settlement offers far below documented losses, refusal to share the basis for coverage decisions, and aggressive tactics to obtain recorded statements or broad medical releases.

How do multi‑party claims after a semi‑truck accident complicate recovery?

Crashes involving tractor‑trailers often trigger multiple responsible parties: the driver, the carrier, a loading company, maintenance vendors, or manufacturers. Each party may have separate policies and defenses, creating opportunities for insurers to shift blame or dispute coverage.

Why are semi‑truck accident cases with catastrophic injuries treated differently than typical car wreck claims?

Severe injuries require long‑term care, future wage‑loss calculations, and specialized medical opinions. Insurers must account for ongoing treatment, rehabilitation, and life‑care planning.

What evidence is most important to preserve after a semi‑truck accident?

Preserve ECM (black box) data, driver logs, maintenance records, cargo documentation, surveillance footage, witness statements, and medical records. Timely preservation prevents spoliation and strengthens liability and damages positions.

How can insurers use social media and surveillance to undermine semi‑truck accident claims?

Adjusters monitor social media for posts that appear inconsistent with claimed injuries. Surveillance may also be used to challenge reported limitations.

When does a low settlement offer in a semi‑truck accident case become coercive rather than legitimate negotiation?

An offer crosses into coercion when it is far below documented losses, paired with artificial deadlines, threats, or misleading coverage information.

What legal remedies exist if an insurer refuses to justify a denial or settlement decision in a semi‑truck accident claim?

Victims can demand written explanations, file complaints with the state insurance department, and pursue bad‑faith or extra‑contractual claims in court.

How does the MCS‑90 endorsement affect semi‑truck accident claims against motor carriers?

The MCS‑90 endorsement obligates insurers to ensure payment for certain public liability claims, even when primary coverage falls short.

What steps should an injured person take before accepting any settlement offer in a semi‑truck accident case?

Obtain a full medical evaluation, request a life‑care estimate if injuries are severe, collect wage documentation, secure carrier records, and consult an attorney.

How can an attorney help when insurers refuse to cooperate with evidence preservation in a semi‑truck accident case?

Counsel can send preservation letters, file motions for sanctions, obtain subpoenas, and coordinate forensic analysis of electronic data.

What distinguishes unfair claim handling from honest negotiation in semi‑truck accident cases?

Honest negotiation involves transparent evaluation and timely responses. Unfair handling features evasive communications, misrepresentation, and tactics designed to delay or diminish payment.

Are there timing limits to bring coverage or handling claims after a semi‑truck accident?

Statutes of limitations and notice requirements vary by state. Missing deadlines can forfeit rights, so victims should consult counsel quickly.

Why should victims avoid giving broad medical authorizations or recorded statements without counsel after a semi‑truck accident?

Broad releases allow insurers to access unrelated medical history. Recorded statements can be edited or taken out of context. Attorneys can narrow authorizations and protect claimants.

⚖️ Disclaimer: The content of this article is for informational purposes only and does not constitute legal advice. The information provided is based on general research and is not intended to be a substitute for professional legal advice or consultation with a qualified attorney. Always consult with a lawyer regarding your specific legal situation.